![]()

On Taxes.

In our modern day state there is an all powerful group of people, a complex of financial and political magnates or a ruling class which directs, often without too much conscious thought, the administrative apparatus of government, its army, its police; and oversees a continuous taxation of the people, in all forms and at all levels. We are all caught in the behemothian jaws of government, the institutions of which are used as weapons which render it almost invincible. The revenue which government needs for its action is gathered as a matter of course, regularly and continuously, its amount is fixed by authority, the taxpayer has nothing to say to it, his only function is to pay.

I do not argue that Government is not needed.1 It is needed. And a government, as John Locke wrote, "cannot be supported without great charge, and it is fit every one who enjoys his share of the protection should pay out of his estate his proportion for the maintenance of it."2 Government, in these modern days, has gone far beyond the role that Locke envisaged for it; its involvement in our everyday activities and the resulting encroachment on our liberty, is an argument to cut it back separate from that which asserts, that governmental expenditure has turned those in control of it into modern robber barons who bleed the people beyond all that which might be expected for the running of good government.

The tax bill for the average Canadian family was reported3 in 1999 as being in access of 46% of that total family's income. Here are the numbers:

| Total Income | $49,996 |

|

| |||||||||||||

| Income-Taxes | 8,466 | |||||||||||||||

| Sales Taxes | 3,742 | |||||||||||||||

| Amusement, Liquor, Tobacco, and other Taxes | 1,526 | |||||||||||||||

| Social Security, Medical, and Hospital Taxes | 4,024 | |||||||||||||||

| Property Taxes | 1,884 | |||||||||||||||

| Import Duties | ||||||||||||||||

| Profits Tax | 1,958 | |||||||||||||||

| Other Taxes | ||||||||||||||||

| Total Taxes | $23,218

| After-Tax Income | $26,778

|

| Shelter | 8,528

| Food | 6,231

| Clothing | 2,120

| Disposable Income | $ | |

Taxes is just one side of the equation, the other is government spending.4 In 1970, government (all three levels) spent, per capita, $1,452; and in 1988, $10,473. The question to be asked is why are politicians such big spenders? Walter Lippmann put his finger on it when he said that our elected officials "hold their offices for a short time, and to do this they must maneuver and manipulate combinations among the factions and the pressure groups. Their policies must be selected and shaped so as to attract and hold together these combinations. ... In the daily routine of democratic politics, elected executives can never for long take their eyes from the mirror of the constituencies. They must not look too much out of the window at the realities beyond."5

Lippmann continues and gives two reasons why democracies6 have become increasingly more unworkable: he puts it down to the growth of intrusive government, and, as a result, an enormous expansion of public expenditure; and the incapacity for people (enfranchised, emancipated and secularized) to believe in intangible realities. "This has stripped the government of that imponderable authority which is derived from tradition, immemorial usage, consecration, veneration, prescription, prestige, heredity, hierarchy." The problem which Lippmann saw back in 1955 is now more sharply and urgently posed; we must come up with an answer, an answer, we should all pray, that will come within the context of a democratic government.

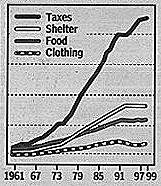

Those in charge of government, ever so hungry for more and more power, as money does bring them, did not give up any previous field of taxation upon entering a new one. No, indeed, the attitude of those in charge of our taxation system over the years, as Walter Bagehot was to observe, is, like the attitude of the Irishman who visits the Donnybrook Fair, "Wherever you see a head, hit it." As for the elected politician, "Wherever you find an article, a product, a trade, a profession, or a source of income, tax it!"7 Today, as we might see from the accompanying diagram the Canadian government taxes its people in every which way, hoping that there will not be too much hissing from any one quarter. The largest is that of income-taxes.8

Income-taxes, no matter that they hit hard those who work for a living, has been one of the favourites of government; due, mainly, I suppose, to the ease at which income-taxes are collected. The government simply imposes on employers a duty (under the pain of heavy financial penalties) to act as government tax collectors, and, to take a proportion on the earnings (taxes) away from the worker before any of it is even given over and to remit it directly to the government. If government didn't collect it this way (payroll deduction) it would have one hell of a tax collection problem, as, I suspect it indeed does have with self-employed people, assuming, for the moment, that the self-employed will cooperate to even report their income.

The Canadian Tax Foundation estimates that between 8½ & 15 percent of GNP constitutes the "underground economy." Potentially that is a huge sum which is going untaxed in Canada, around $10,000 per family. Most people are willing to pay their fair share of the taxes; but when they perceive that the tax system, to begin with, is unfair and that others are not paying their share -- then they forgive themselves if they can skunk the taxman. The fact of the matter is that in 1981 the average Canadian worker paid $3,792 in taxes; by 1991-2 the average was $8,576. Because of the increasing tax burden, a shift in attitude has occurred. The conclusions reached by a major accounting firm in Canada, as set forth in their report, was that 19% of the Canadians polled would hide income if they thought they could get away with it; 26% would buy smuggled goods; 32% would smuggle in goods; and 49% would readily pay cash with no questions if they could get away without paying the sales taxes (HST). Further, and it is likely no simple coincidence, that with the introduction of the HST (a direct sales tax) in the early 1990s there was to be, by 1993, $100 billion more bank notes in circulation than there was before its introduction.9

In an effort to catch every possible dollar and to cover off any ambiguity or omission which might afford the inventive taxpayer an opportunity for evading its intention, tax law has become extremely complex. It runs to hundreds of pages, related tax regulations run it up into the thousands. Then there are the Tax Interpretation Bulletins, Tax Treatises, Tax rulings, and, on and on -- all written in a language pitched to the anointed, they who are charged with writing, interpreting and applying tax law. The process is beyond most of us, a Serbonian bog in which accountants and lawyers rule. This of course, in the ranking of things, such as food and housing, is a straight economic waste of resources.10A

The system calls out for reform, for simplification.10 For example, why does a wage earner, maybe with a little supplementary interest income, have to fill out pages and pages of government forms each year?11

I cannot pass on without writing a few words on corporate taxes. One of the tricks of the self-interested, those who wish government to spend public money on their pet programs, is, that all that need be done to finance these programs is for the government to tax the corporations. The politicians on the campaign trail spout, "We are not going to tax you, we are going to tax the corporations." The fact of the matter is that when a group of people, a company of people, incorporate themselves they create a legal entity, no doubt; but the payers of the tax - no matter the way you cut it -- are still real people and not the legal fiction we know as a company. More often then not, as opposed to the people who own shares in an incorporated company12, it's the consumers of the products and services which that company provides which pay the taxes. Taxes, for a company, is but another expense which the company figures in, before it sets its prices. These "tax the corporations" people get away with their vote gathering position, simply because the average person has no appreciation of the "incidence of taxes," viz., the person who bears its burden is not necessarily the person or entity against which the tax is levied. It is enough, when considering the question of whether corporations should be taxed or not, to know: in the final analysis corporations do not pay taxes, people do. Incidently, the elimination of corporate taxes would reduce the complexity of taxes to a very great degree; and release to the community, as a whole, the vast resources that governments use in the implementation and collection of corporate taxes and that the companies use in arranging its affairs so to avoid paying taxes. I would advocate that income, of any kind, be fully taxed (see fn#10 on flat-tax) but only when it comes into the hands of a real person.13

Most believe that government has "a right" to tax; and, likely, they do; but it is limited as all government action must be. I believe that whenever government, at whatever level, takes money from the people, taxes the country's resources beyond that which is needed for the fundamental purposes of government (paying interest on government debt is not one of them) then those charged with the running of government go beyond the constitutional role of government and breaches the rights of the citizens which it seeks to tax.14

Deep cutting taxes not only harms people by depriving them of their property, but impacts the larger community in several respects. People become discouraged and will do little to increase their productivity. High tax levels promote, as we have seen, evasion. People who evade taxes do not see it as a crime of not paying their fair share but of a way to get out from under an unjustified confiscation of their property. The more serious danger, is, that, as tax evasion and smuggling become increasingly more common (proportionate to increasing tax levels) the unwillingness to commit other crimes, more generally, becomes less.

The greatest observable abuses of government in the past two decades has been the abuses of the governmental power to tax; without any doubt; ask any citizen. But to say that government taxes too much, is just another way of saying our government spends too much. And who is to control government spending, - a cabal of powerful people within it! Giving government limitless spending power is leading us to economic ruin. Government must be limited by a country's constitution: if not the power to spend; if not the power to tax; then limit, at the very least, the power to run up debt.15 However, short of the threat of an armed insurrection, it is not likely that those who make up government should initiate the necessary constitutional changes; it is much more likely that one would be successful in talking an addict into cutting back on his heroin use. It has been a long time since government expenditure, in any given period bore a direct relationship to the money it raises by the imposition of taxes, in that period. It, government, has simply spent and spent, and what is not covered by taxes in any one period is altogether too simply added on to an ever mounting government debt.16

In a true democracy a government cannot budget for an operating debt, and it would be absolutely constitutionally barred from carrying a debt from one fiscal period into the next. As for taxing powers, a government in a true democracy could not constitutionally tax other than in a democratic manner, viz., in such a way so as to have the taxing burden fall in a level and equal way on each voter. In a true democracy one will not find a persistent tendency for government to overspend; and the reason for that is, that the majority of voters will not receive, in the spending year, more from the government in benefits than they pay in taxes.

Government, for a short if cynical definition, is a group of individuals organized for the purpose of extracting wealth and exerting power over people and resources. To extract, let's see, sounds like something a dentist does to your tooth. Indeed, in looking up the word "extract" one will find other words, such as: "pull," "remove," "suck," "tear," "withdraw," and "yank." Yep! Sounds like a dentist alright. And, Yep! It sounds like government, too! Now assuming we are the ones that give government its power to extract wealth and since most of us are the ones to sit in the dentist's chair (so to speak) -- Why would we want to give the power to another group of individuals to take our money, to tax us? It is not likely we can carry our government/dentist analogy too much further, except to say that it does us good to have our rotten teeth pulled out, but, and I hasten to add, not our good ones, as we need them to chew. Every bit of wealth is important to its possessor, not any of it is rotten (though no doubt it can be put to rotten purposes). The fact is, government needs wealth for its great purposes and to the extent that our wealth goes to serve these purposes then that is good; at least as good as getting rid of a rotten tooth, even though, for many of us, handing money over to the tax man is considerably more painful than having one's teeth pulled.

[TOC]

1 See bupete's essay, "On Government."

2 Two Treatises of Government, 1690.

3 See National Post, April 17th, 1999.

4 To the extent that fiscal policy can be used to the good of society, profligate government spending leads to increasing dullness and ultimate destruction of it as an economic tool. See my note on Keynesian theory contained in my brief sketch on John Maynard Keynes.

5 The Public Philosophy (Boston: Little, Brown; 1955).

6 Our forefathers might have thought that with the abolition of monarchial power and the vesting of the sovereign power in our elected assemblies we would have, at the same time abolished kingly waste and unaccountability. But? Alas! Not so. In our modern day governmental structures, the hereditary abuses of long ago are perfectly preserved, with large revenues imperfectly accounted for, with the perpetuation of a hundred detestable parishes, with the perpetuation of a horde of luxurious and useless bodies. (See bupete's essay, "On Democracy.")

7 The English Constitution (1867) (Oxford University Press, 1928).

8 In days past, the only effective tax, if kept at low levels, was that imposed on imported goods, followed by the land tax. It was only with the government machinery put in place by Prime Minister Pitt, on account of the impetus of the Napoleonic Wars, in 1799, that, in Great Britain, the first income-tax was introduced. It, presumably, was eliminated directly the war debt was paid off. In 1842, however, the income-tax was reintroduced, and, has existed ever since. (OED.)

9 The information and figures contained in this paragraph has been taken from an article, "An economy moves underground," as found in the National Post, April 17th, 1999.

10A William Hazlitt wrote an essay, "On the Effects of War and Taxes," apropos to this subject, "economic waste of resources"; I highly recommend it to the reader.

10 The most widely-discussed radical proposal for tax reform is the flat tax. Briefly, the flat tax would tax all income once at a uniform rate? In the United States, there is a suggestion that the flat tax should be set at 19%. And further, there is to be a tax-free allowance -- $16,500 for a married couple, $4,500 per child -- with income above that to be taxable. With such a tax, the personal income-tax form could be reduced to about the size of a post card.

11 I do not know the number (presumably the government does) but it would appear a vast industry has sprung up which charges a fee to fill in a "simple" tax return. Then, these tax preparers, having these people in their grip, and because the government has over-collected and is slow to return that which belongs to the taxpayers, resort to usury by discounting the "refund" and giving it to the desperate taxpayer, on the spot, in exchange for an assignment.

12 And, it is to be born in mind, that owners of the large companies are often mutual funds and pension plans which in effect spread the ownership of companies far and wide.

13 I want to emphasize this: no distinction should be made between ordinary income and that of dividends and realized capital gains. Further, as for the deductibility of charitable donations: it should not be allowed. Thus with no registration requirements there will not exist a structure were there exists favoured charities. Charitable decisions will be made on the basis of worthiness and not on the basis of where a person can get the best tax deduction. At any rate, there is now evidence that people, by and large, are not driven to make charitable donations on the basis of tax deductions.

14 For an examination of this question, the constitutional restriction in respect to taxation, one likely should start with the The English Bill of Rights of 1690 which I deal with in my pages on the The Canadian Constitution.

15 This would be a simple constitutional change: add these words to section 91, sub. 4 [federal] and to section 92, sub. 3 [provincial], - the sections in the B.N.A. Act that allow for the "Borrowing of Money on the public Credit" - "but, where the borrowing is required for operating expenditure as opposed to capital expenditure, then the borrowing is to be restricted to not more than the average of its operating expenditures over the previous five years."

16 Government, especially in the past thirty years, have not had the courage to tax to the same extent that they have spent, preferring deficit financing. It is a bad way to go, such that, somewhere between a quarter and a third of our collected taxes is now spent on interest payments.

[Essays, First Series]

2015 (2026)

_______________________________

Found this material Helpful?_______________________________

Quotes:-

NOTES:

_______________________________

[Essays, Second Series]

[Essays, Third Series]

[Essays, Fourth Series]

[Subject Index]

[Home]

[Top]